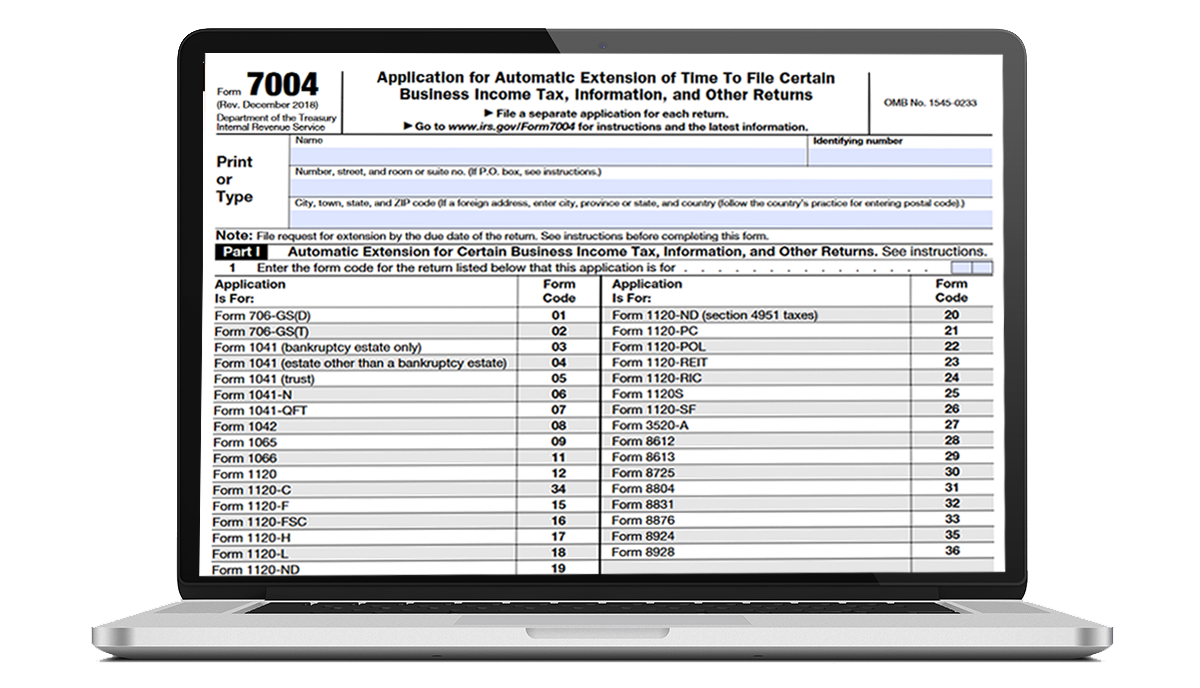

E-File 7004 Online with an IRS authorized provider

Efile7004online.com is an IRS-authorized E-File Provider who provides the most safe, secure solution to file business tax extension electronically.

The great advantage of e-filing 7004 Form with our software is the processing of your return at which the return can be transmitted to the IRS. Once the form is transmitted to the IRS, it is typically accepted within minutes of filing.

When you are in the last minutes of the deadline, it helps business owners from paying

unwanted penalties.

E-file Form 7004 Now and Get up to 6 months Automatic Extension.

Advantage of E-filing 7004 Over Paper Filing

IRS Recommends e-filing of tax extension Form 7004 for

- Quick Processing

- Accurate Filing

- Getting Instant Notification

- Avoiding Paper works

.png)